This post was written in collaboration with CIMB SINGAPORE. While we're financially compensated by them, we nevertheless endeavor to maintain our editorial integrity - which means reviews are free from all biases and all views expressed in this article are independent opinions.

From now till 31st December 2021,

Exclusive to Smart Towkay users, get up to S$200 Cash credit when you opened a CIMB SME account with us!

Click herefor more information!

In this world of stiff competition and ever-changing technology, SMEs need to be as agile as possible thus opening your business banking account as soon as your company is incorporated is becoming more imperative.

At a time when there are so many things to worry about, the last thing you want is your business and personal finances mixed up. By opening a minimum deposit corporate account in Singapore for your company, it will allow you to separate those two types of financial information which makes monitoring them easier and more straightforward.

Clean and accurate bookkeeping aside, you would also want your business to maintain a professional edge. Having the company name appearing on cheques and other payment methods for customers and clients signals a formal dedication to your organization.

Setting up a business banking account with online corporate account opening platform Singapore is an established practice and need not be a complicated process. However, it can be daunting for a new business owner in Singapore to be confronted with so many different banking options.

In evaluating a business bank account, the most important things to look out for are:

Monthly fees

Minimum deposit and balance

Usability and ease of access

Smoothness of the application process

Limits on transfers and foreign currency conversion fees

Customer support networks

For optimal convenience, a business banking account that can be set up seamlessly online, with full digital functionality and support, would be ideal.

In this regard, CIMB’s Online Account Opening platform helps to achieve this aim by allowing a SME regardless of whether you are a sole proprietorship, partnership or a private limited company, to apply for an account online.

Monthly fees, minimum deposits and balance

When first starting a new company, you would want to keep your costs low. It is not likely that your business in its early days will have the prestige and scale that allows it to fully make use of any perks that come with an expensive banking account. Simplicity has its strengths at the right time.

You would also be loath to sink a large proportion of your starting capital into your banking account just to fulfil its minimum initial deposit requirement and to maintain its minimum balance thereafter. Some banks require a five-figure sum as a minimum deposit and balance, which represents a significant outlay.

Make Better Use Of Your Funds And Stretch It Further

CIMB’s SME Account requires no minimum deposit or minimum balance at all, which can help to keep operating costs low, and free up more capital for actual business purposes. All it takes is a S$28 monthly account fee and a full-fledged online business banking account is at your disposal.Opting For A Minimum Deposit Corporate Account Makes Financial Sense

Most Corporate current accounts will require a S$10,000 minimum daily balance, when you deposit money with a bank, there’s an opportunity cost.

Imagine you are a start-up, and boot-strapping it. The need to maintain a 5 figure daily balance with the bank means that instead of using it to generate revenue, your money is stuck with the bank for fear of the fall below fee charge. Other considerations could be credit card debt, auto loans or even your home loan, so you’re probably paying interest on these loans. The S$10,000 will be put to better use in this case.

Usability and other costs of usage

Your banking account needs to provide you with the conditions to fulfil your banking needs effectively and efficiently. Intrinsic to this consideration is also the cost of transacting since this is effectively what you would use the account for.

Through BizChannel@CIMB, CIMB’s online business banking portal, accessing all transaction options, such as paying and receiving funds, is a breeze. Transactional pricing is also very attractive.

In fact, SME Account has greatly streamlined its charging structure. There is a S$15 flat fee for each Outward Telegraphic Transfer (The S$15 dollar charge is applicable to SHA/OUR charge type. Agent Fees may apply) while all FAST, GIRO, and Payroll transactions are completely waived. This makes it simple and easy to understand.

For companies that are looking for a Shariah-compliant alternative, the BusinessGo-i Lite would be the equivalent account that offers the same features and benefits.

To access internet banking, companies would still require tokens. CIMB waives its fee for the first three tokens, only charging S$20 for the fourth one onwards, which represents a good perk that is not offered by most other banks.

Many banks also offer an E-Alert service, which is an email/SMS service that informs you of your account balances as well as alerting you of specific account and trade finance activities. Some banks would charge a fee for each mobile number or email address it sends an alert to. CIMB does not charge any.

Do you know Malaysia Incorporated Company can apply for CIMB SME account in Singapore?

Fast and easy application process

You’re eager to put your company on the map and you’re ready to hustle. Speed is of the essence. While almost all banks have streamlined their application process to incorporate online application, many of them still have some physical meet-up requirements, thus slowing down the application.

Through CIMB’s online application platform, opening an account online is absolutely seamless and approval can be obtained quickly. In fact, you can open a SME account in as quickly as 15 minutes* and begin transactions the same day. Start collecting your revenue the same day you incorporate your company!

* T&Cs Apply.

SGD SME/ Business Go-i Lite Features

Account Name | SGD SME / BusinessGo-i Lite

|

Credit Interest (Y/N) | N (non-interest bearing) |

Minimum Initial Deposit | nil |

Minimum Avg Daily Balance | nil |

Fall-below Fee (Monthly) | nil |

Account fee (Monthly) | $28 per month |

Early Account Closure Fee | $40 (closed within 6 months of opening) |

Cheque Book Fee | $25 per book |

Cheque Clearing Fee | Free |

Transactional Pricing Above pricing is only applicable for transactions performed via BizChannel (ie. online transaction); If non-online (ie. manual transaction), then the standard pricing for manual transactions apply.

| OTT* $15 flat FAST, GIRO & Payroll (Single & Bulk)- Free

|

Internet Banking Fees | Waived for first 3 tokens (S$20 per token from 4th token onwards; S$20 per token for replacement of lost token)

Includes access to BizChannel Mobile and any online/video training relating to BizChannel |

*SGD deposits are insured up to S$75,000 by SDIC

Step-By-Step Guide To Opening CIMB Digital Account (Online Application)

For SMEs that are looking to open SGD SME, click here

Before proceeding, make sure you have the below-required documents ready:

1. Certified True Copy Company Memorandum and Article Of Association (M&AA);

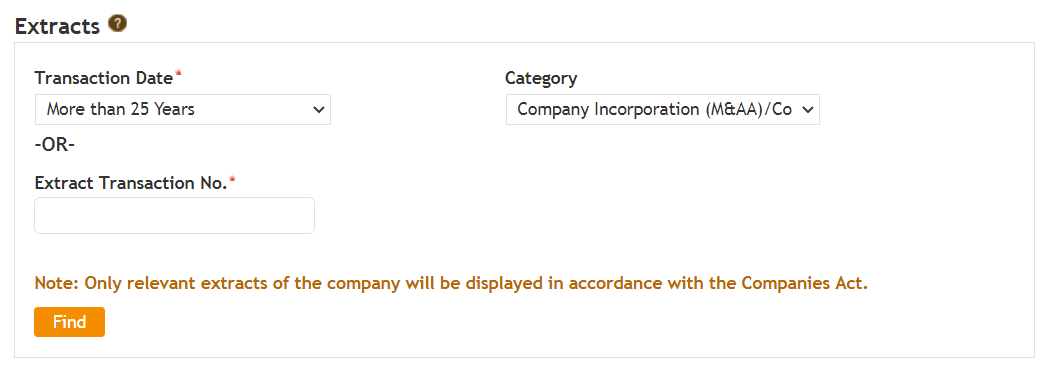

(If you have misplaced it, you can buy yours at Bizfile.Gov.SG-> Buy Information -> Extract)

2. Identification Documents (Back of NRIC or Passport) with e-signatures (for Directors, Approving Persons, Authorised Signatories & Ultimate Beneficial Owner);

3. Identification Documents (An image of yourself holding the front of your NRIC or Passport on your right)

- Image must be in a landscape format

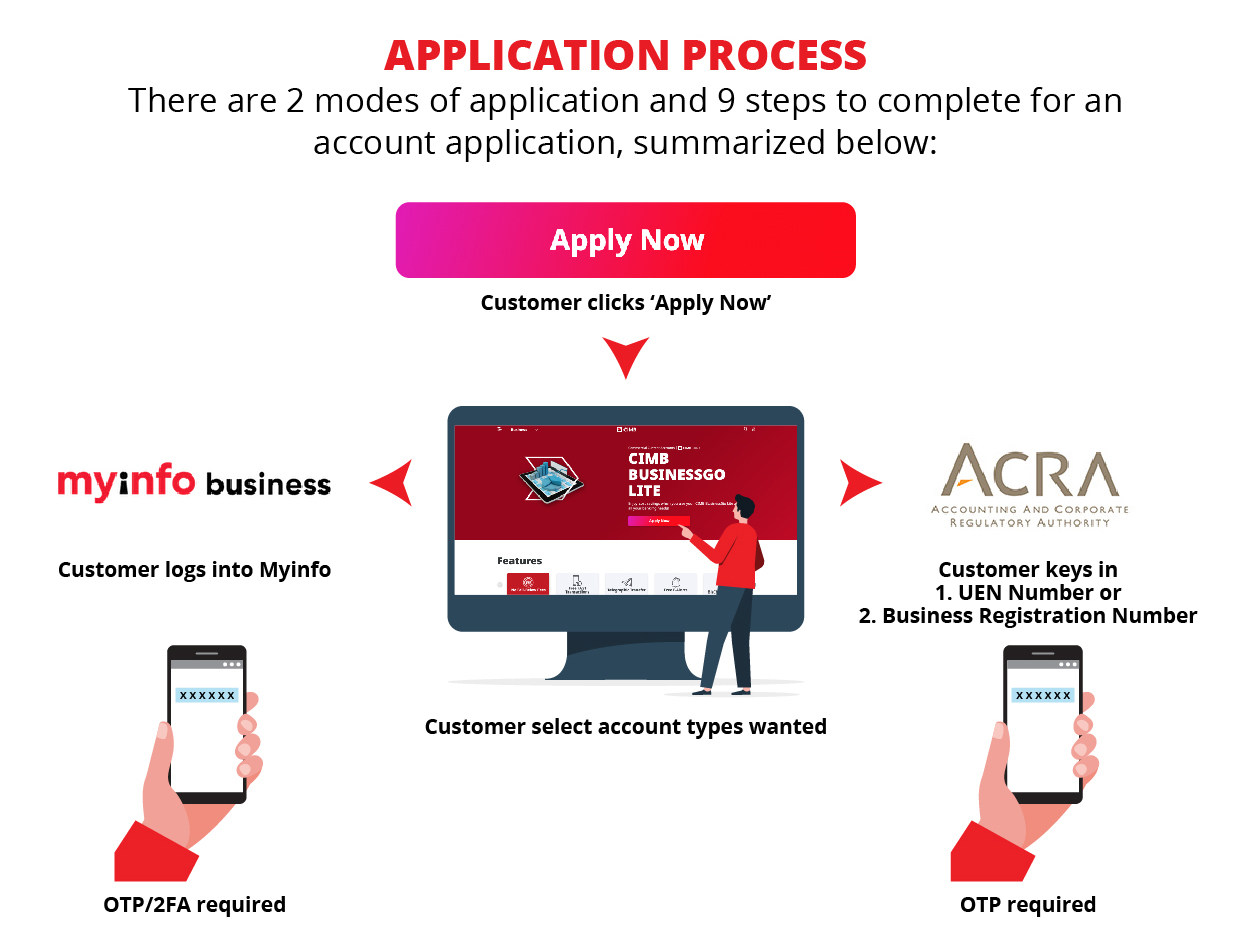

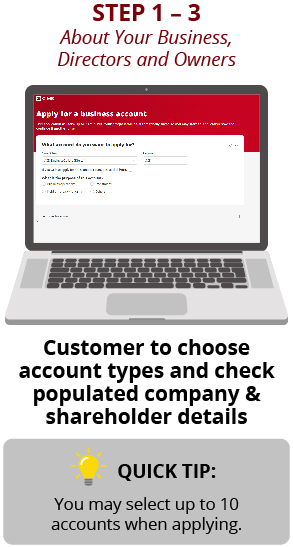

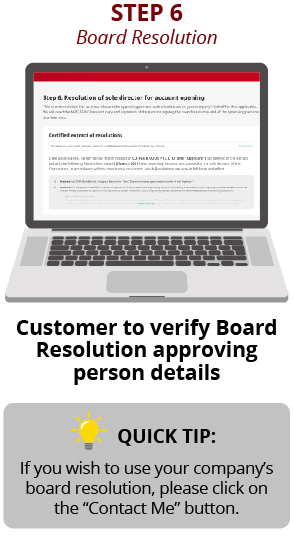

CIMB Online Account Application Process

Open your CIMB SME Account today!

CIMB SME offers different low-cost options by doing away with either minimum deposit and balance or monthly fees. Transactional pricing is also reasonably low. A quick and seamless application process offers appealing convenience. Overall, this is a strong candidate for many young start-ups and fledgling companies to consider when looking for a business banking account.

For SMEs that are looking to open SGD SME Account, click here

Singapore Budget 2025: What SME Owners Need to Know

Singapore Budget 2025: What SME Owners Need to Know Review: MariBank | Mari Business Loan (Credit Line) – Do I Need a Business Credit Line?

Review: MariBank | Mari Business Loan (Credit Line) – Do I Need a Business Credit Line? Banks in Singapore - Do They Reimburse Losses from Scams and Fraud?

Banks in Singapore - Do They Reimburse Losses from Scams and Fraud? Singapore Businesses’ Guide to Hiring Interns + Grants For Interns [2024 Updated]

Singapore Businesses’ Guide to Hiring Interns + Grants For Interns [2024 Updated] Understand the Basics of Credits and How to Avoid Getting into Bad Debt

Understand the Basics of Credits and How to Avoid Getting into Bad Debt

.jpg)