- Singapore Budget 2025: What SME Owners Need to Know

- Review: MariBank | Mari Business Loan (Credit Line) – Do I Need a Business Credit Line?

- Banks in Singapore - Do They Reimburse Losses from Scams and Fraud?

- Singapore Businesses’ Guide to Hiring Interns + Grants For Interns [2024 Updated]

- Understand the Basics of Credits and How to Avoid Getting into Bad Debt

- Comprehensive Guide to Data Protection Officer - What SME Owners Need to Know [Updated]

- How to avoid being a victim of credit frauds/scams?

- Why do employers conduct background screening?

- Corporate Compliance in Singapore: Guide for SMEs and Businesses

- Should I Switch My Corporate Secretary Partner?

How Does Inflation Affect Your Insurance Policy?

As prices for goods and services rise, so too do insurance premiums. To adequately manage risk, insurers must account for the higher claims costs associated with this inflation-driven increase in their payments.

US insurance policy quotes are up by 11.8% due to internal and external economic factor such as conflict overseas (Russia-Ukraine War affecting global gas prices), creating a greater divide between those who can secure coverage and those who cannot afford it - leaving many policyholders opting out of renewal in order to save money during financially turbulent times. It is clear that rising inflation presents both customers and insurers alike with difficult economic decisions concerning how best to navigate our current climate of uncertainty.

Outlook On Inflation

Concerns about a wage-price spiral, how quickly the Singapore dollar is gaining, and the effects of the impending GST increase are raised as Singapore's inflation climbs.

According to conventional thinking in the insurance industry, claims get more expensive the longer they take to resolve. For instance, if an earthquake damages a property, a policy might need to pay for temporary housing for the residents while repairs are made. The cost of insurance increases as those repairs take longer and costs of repairs rise due to inflation. Another noteworthy example is supply chain issues/disruptions due to COVID.

When investing as an investor or business owner, it is critical to ensure that your returns on investment do not drop below the rate of inflation. If this happens, you will essentially be losing money despite ROI gains.

1) Wage Inflation

Wage inflation has been rising steadily due to economic crisis globally and pandemic in the last few years. According to ECA International, in 2022, workers in Singapore received a salary increase of 3.8% in nominal terms and this rate of growth is forecast to rise further to 4.0% this year (2023). Inflation in Singapore last year is 5.5%, similar to the average rate of inflation in the region, and is expected to fall to 3.0% in 2023.

The MOM attributes this upward trend to the implementation of the Minimum Wages Order (MWO). In addition, the MOM says that the minimum wages will continue to increase until the end of 2022 and that's when actual inflation will recede in 2023.

2) Impact On Interest Rates & Insurance Policy

Inflation can affect your business insurance policies in several ways.

First, it reduces the value of your savings.

Second, it makes your monthly business and operational expenses go up as purchases are more expensive.

Finally, it erodes the value of your assets.

For instance: If you have building insurance for your company, the cost of rebuilding your property (whether residential or commercial) will go up due to growing material costs and a labor shortage.

What about interest rates? Let's find out in details more about current insurance market.

The quantity of attention regulators and other insurance perspectives from industry observers have given to the idea of total return in the business has increased along with interest rates. Income from both underwriting and investments is taken into account when calculating overall return. By focusing on total return, market analysts have generally concluded that since investment income is increasing due to rising yields, underwriting profit margins can be decreased, erased, or in some cases turned into losses while total returns are maintained.

Investable assets generate a higher return as interest rates rise, raising the overall business return, unless this benefit is negated by a reduction in underwriting gains. As a result of inflation, insurance companies see higher written premiums even when renewing the same number of exposures in future years. Even health insurance premiums will occasionally surpass or behind the overall inflation rate, they will eventually catch pace with inflation.

Why Does Your Insurance Company Raise Your Rates?

There are several factors that influence the price of insurance premiums. These include the level of interest rates, inflation, exchange rates, and changes in the economy.

As you know, most insurers base their charges on a percentage of the cost of the property insured. If the price of an item goes up, then so does the percentage charged. Since inflation has been a constant over recent decades, the costs of items have risen just as much as the percentage charged.

The availability of materials, for example, used for basic needs in housing and vehicle parts has decreased due to lessened imports and to acquire these materials drive up your property and auto insurance costs. Why? You will find out more later.

For Your Business/Personal Insurance Policy:

1) Analyzing Weaknesses: Insurance Claims And More

Different types of business are affected by different causes that increase claims costs. Disruptions to supply chains have had a significant impact for certain goods, such as automobiles and auto parts; worldwide market turbulence has been particularly severe in the commodities and energy industries.

Insurance companies must prioritize enhancing claims efficiency and automation, as well as managed-care network use and negotiated pricing, while balancing these efforts with cycle time improvements and claims accuracy in order to efficiently control such expenses, i.e. claims cost inflation.

Businesses face a far greater threat from cyber-attacks than individuals. This is because businesses operate at a larger scale and therefore are more vulnerable to attacks. A successful attack could cause serious damage to a company’s reputation and financial stability.

IP theft and lost opportunities can be lethal for businesses, especially for small and medium-sized ones. IP theft and lost opportunities are two areas of cyber crime damage that are very difficult to evaluate.

When cybercriminals identify a weakness, they seize the opportunity, which in the best scenario may result in a temporary website blockage (DDoS attack) or, in the worst case, a complete security breach. System vulnerabilities can be extremely hazardous because of this. It all happens because there is an imminent desire to ask for ransom due to the conditions that inflation has on everyday life.

Demand for cyber insurance among businesses have been larger than ever. Cyber insurance is advantageous for companies that produce, store, and handle electronic data online, such as credit card details, client contacts, and consumer purchases. Cyber insurance is also advantageous for e-commerce companies because downtime brought on by cyber disasters may result in a loss of clients and sales. Similar to how any company that keeps client information online can gain from the liability protection offered by cyber insurance policies.

Policy Navigation

All of these indicate to a number of policy precarious situations that the government must take in the next months.

The first is the rate and degree of monetary policy tightening. Since October 2021, the MAS has lately announced four policy tightening actions. The Singapore dollar has risen against other major currencies, such as the yen, the euro, and the British pound, even reaching record highs.

By stifling aggregate demand and spike in inflation, the Singapore dollar's appreciation versus the majority of its main trade partners has helped to contain imported inflation and reduce pricing pressures, but this will limit economic development.

2) Is It Possible To Turn Inflation Into Opportunities?

Any sort of investment hedging has advantages and disadvantages, just like every type of investment.

Naturally, the main advantage of investing during an inflationary period is to maintain the value of your assets. Your desire to maintain the growth of your nest fund is the second justification. Additionally, it might encourage you to diversify, which is always a good idea. A tried-and-true way of building a portfolio is to spread the risk among a number of holdings, which may be used for both asset-growth and inflation-combating methods.

| Pros | Cons |

| Maintain portfolio value | Increase in risk exposure |

| Expand your possessions | Abandon long-term objectives |

| Continue to have purchasing power | Portfolio that is too heavy in some classes |

How Does Inflation Impact On Insurace Premium Going Forward?

Who do you think will be the most affected if this is an impeding impact? The insurers, indeed.

Separating the effects of inflation into those for current and future losses and those for historical losses and reserves may help to better understand the impact of inflation on liabilities.

The insurer would lose money on the entire transaction. In order to cover the increased costs, they raised your premium by higher percentage but what they mean is that they jacked up your annual percentage charge (APC) - taking advantage of the fact that you don't realize that inflation is eating away at your purchasing power.

Higher inflationary settings cause expenses for insurance operations and claims to rise faster than anticipated, lowering current period income. As insurance companies re-price their plans to account for increased costs and claim costs, this can be substantially alleviated. Insurance providers maintain reserves for past losses, both known and unknowable, and when future prices rise, the amount set aside for these losses may not be sufficient. In worst circumstances, it might necessitate setting aside more money in reserves to cover losses from earlier periods.

This is where we want to emphasize that there is no way to avoid paying more for inflation. It's not worth to fight it by claiming that your insurance company is charging too much.

Insurance Inflation Protection

The best way to protect yourself against inflation is through an effective inflation protection strategy. It should be part of your overall risk management framework.

Inflation protection strategies are designed to help you hedge against the effects of inflation. They allow you to lock in the purchasing power of your savings over time.

An inflation protection strategy allows you to buy an inflation-linked bond (ILB), which pays out a fixed or variable rate of interest every year based on the Consumer Price Index (CPI).

Read how MAS is considered introducing ILB to the Singapore Government Securities (SGS)

An ILB is usually issued as a coupon bearing security, meaning that investors receive periodic payments in addition to the principal sum invested.

It also provides a guaranteed return with no risk of loss. However, there is a minimum initial investment required.

There are two types of ILBs:

1. Fixed Rate Bonds - These pay a fixed rate of interest each year based on the CPI.

2. Variable Rate Bonds - These pay variable rates of interest based on the CPI. This means they fluctuate greatly.

Fixed rate bonds were originally used primarily to provide pension funds with a stable source of income. Variable rate bonds, on the other hand, were initially used by banks and other financial institutions to provide short term financing.

Today, ILBs are widely available to individuals and businesses. They are offered by many different issuers including governments, corporations, mutual funds, and private equity firms.

Inflation Proof Your Earnings

Hedge your wealth; it's easier said than done in reality. But here's how you can inflation proof your income.

Singapore Savings Bonds

Singapore Savings Bonds (SSBs), for example, are a good example of a government bond.

Returns are lowest in Year 1 and highest in Year 10, respectively. For instance, if you purchased SSBs in September 2022 and held them until maturity, you would receive a return of 1.69% to 2.71%. You would receive less money if you sold the bond before 10 years.

The assumption of rising global interest rates has resulted in increase in SSB interest rates.

If you are interested, keep an eye on when the Monetary Authority of Singapore announces the SSB interest rate in the beginning of every month here.

Corporate Bonds Investment

Another best option to hedge against inflation is to invest in Corporate Bonds.

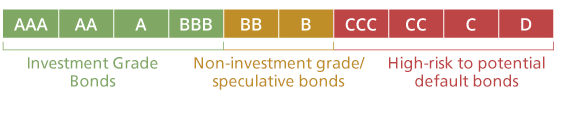

Credit ratings, when available, serve as indicators of credit quality. In the view of the credit rating agency, the bond issuer's financial position is stronger the higher the credit rating. Various credit rating firms employ various rating systems.

Standard & Poor's, a well-known agency, employs the system as below:

An unrated bond does not, however, imply that the issuer has a dire financial situation. In certain instances, the issuing firm is so certain that the sale of its bonds will be based on its name recognition or good standing that it does not wish to invest in obtaining a credit rating.

In such a case, you run the real risk of making a loan only based on reputation, which may or may not be indicative of actual credit quality, unless you have the ability to independently evaluate the non-rated issuer's balance sheet, profitability, cash flow condition, and outlook.

Conclusion

To conclude, having a well-developed risk management plan is your key to navigating the world's uncertainties, remaining relevant for your clients, and being successful in delivering value to all of your stakeholders, whether you are dealing with a pandemic or a series of global challenges that cause inflation.

Niche industries like aviation, trade credit, political risk, and marine insurance are among those vulnerable to increased claims as a result of the conflict in Ukraine. Cyber insurance could become more popular.

Based on continuous rate hardening, particularly in commercial lines, we anticipate a return to positive growth in non-life in 2023, with worldwide premiums increasing by 2.2%.

Next year, we anticipate that the effects of high interest rates, robust investment returns, and improved underwriting outcomes will begin to manifest themselves in increased profitability.

Frequently Asked Questions

What are some of the most important things I need to know about inflation protection?

You need to have a clear understanding of how inflation works. You also need to make sure that you understand what kind of inflation protection you want.

For example, if you want to protect against rising food or energy prices, then you need to choose a product that protects against price increases in those areas. If you want to protect against falling real estate values, then you need to look at products that protect against declines in property prices.

If you don't understand how inflation affects your life, then you won't be able to decide whether or not to invest in an inflation protection product.

Do all investments offer inflation protection?

No. Not all investments offer inflation protection. Some only protect against currency devaluation. Others only protect against rising commodity prices. Still others protect against rising interest rates.

What can I do to lower my insurance premiums?

If you're looking to reduce your insurance premium, there are many things you can do. One thing you can do is shop around for different insurance companies. This means comparing rates from different insurers so that you can find the best deal. If you want to compare rates with other companies, you'll have to ask them for their rates. Some companies may not give out their rates unless you request them.

Another option is to look into bundling your insurance policies together. Bundling your policies together means having all of your policies under one roof. It also means paying less for each individual policy because you're only paying for one instead of multiple policies.

Read also: 6 Tips For Small Businesses to Improve Their Risk Management

Read also: Step-by-Step Guide: Top 7 Reasons Why SMEs Should Buy Work Injury Compensation Insurance

Got a Question?

WhatsApp Us, Our Friendly Team will get back to you asap :)

Share with us your thoughts by leaving a comment below!

Stay updated with the latest business news and help one another become Smarter Towkays. Subscribe to our Newsletter now!